Fact sheet

We are a multi-energy company present in each link of the value chain. We offer a comprehensive range of products and services that make people’s daily life easier and help ensure the sustainable progress of society.

We are a multi-energy company present in each link of the value chain. We offer a comprehensive range of products and services that make people’s daily life easier and help ensure the sustainable progress of society.

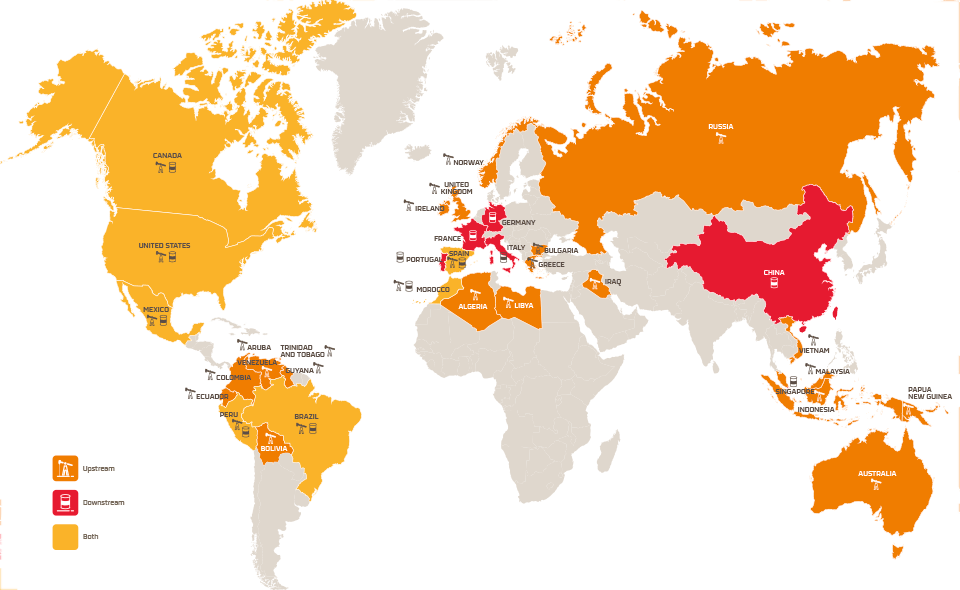

Over 25,000 employees in 35 countries.

Average net production: 715 thousand barrels of oil equivalent per day.

Distribution of petrochemical products and lubricants in over 90 countries.

Service stations: 4,800 in Spain, Portugal, Peru, Italy, and Mexico.

Seven industrial facilities in Spain, Portugal, and Peru, with a refining capacity of more than 1 million barrels per day.

10M clients base with direct contact.

Responsible mobility: 1,700 electric vehicle charging stations and 732 autogas supply points.

We have incorporated low-emissions power generation assets, with a total installed capacity of 2,952 MW and planned projects worth an additional 1,083 MW.

C02 emissions reduced by 4.9 million metric tons between 2006 and 2018.

Repsol worldwide

Repsol worldwide

Upstream's adjusted net income in 2018: 1.325 billion euros. 110% more than in 2017.

Efficiency and digitalization are the two drivers behind the Company’s constant business improvements.

Average production increase of 3% in 2018.

Average net production: ~715 thousand barrels of oil equivalent per day.

Net proved reserves: 2.34 billion barrels of oil equivalent in 2018.

Percentage of gas in our asset portfolio: 63% of production and 73% of reserves.

Downstream's Adjusted Net Income: 1.583 billion euros.

Refining margin indicator: 6.7 dollars/barrel.

Repsol has 890,000 electricity and gas customers with the aim of reaching 2.5 million customers in Spain by 2025 and a market share of 5%.

More than 4,800 service stations worldwide.

We distribute lubricants and petrochemical products in over 90 countries.

Increase in lubricant sales: ↑13% on international markets compared to 2017.

Waylet: this cell phone payment app has 1 million users.

4,500 MW: total installed electricity generation capacity objective for 2025.

Climate change

In 2018 we have defined a new GHG emissions reduction plan for 2018-2025 with the objective of achieving an annual reduction of 3 million tons of CO2e at the end of the period compared to 2017.

People

We invest in people and promote their development. More than 80% of the workforce participated in training activities in 2018.

Technological innovation

We promote innovation and incorporate technological advancements to keep improving. 200 R&D projects.

Operational safety

We guarantee the safety of our employees, contractors, partners, and the local communities. 24% decrease in the process accident rate.

Ethics and transparency

We act in a responsible and integral way. 13.6 billion euros paid and raised in taxes.

Circular economy

We will develop actions to promote the efficient use of natural resources. Over 120 circular economy initiatives.

Educational programs

We inform future generations about energy challenges. Over 50,000 students have taken part in Fundación Repsol’s LearningEnergy program.

15 billion euros: planned investment in the 2018 – 2025 period.

Annual growth of the dividend per share of 8% through scrip dividends, along with share buyback.

Dividend payout fully covered at $50/barrel.

Operating cash flow improves dividend cover from 3.9x in 2017 to 4.3x in 2020.

Long-term sustainable payout.

Improvement of all value creation metrics in any price scenario.

Downstream: a growth driver that does not require big investments in assets.

Upstream improves its performance and its assets portfolio.

Sturdy portfolio of growth projects in both businesses.

New long-term opportunities under development.

Driven by our competitive advantages.

Carbon footprint reduction Construction of new capacity.